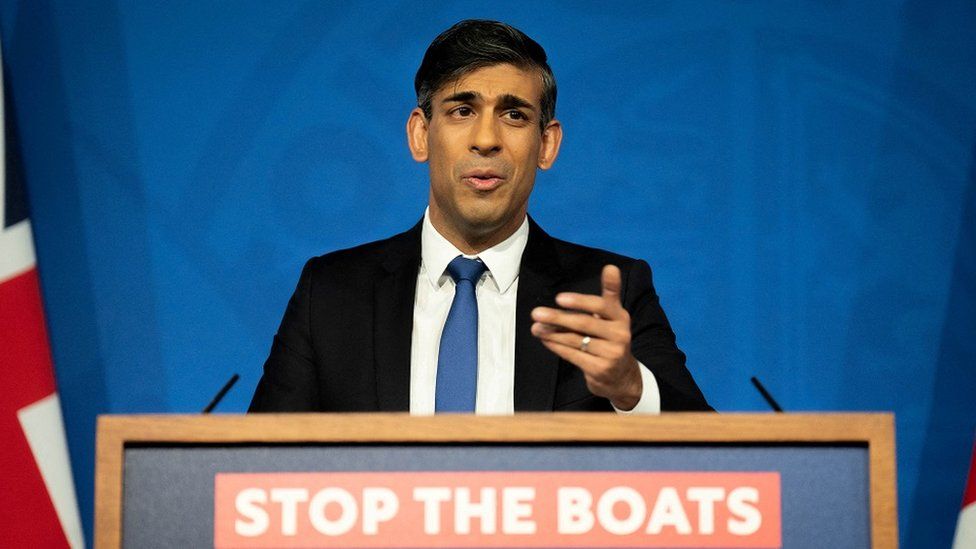

UK Prime Minister Rishi Sunak is in despair. He is losing voters on both the right and the left and...

Belfast rapper Kneecap is threatening legal action over the UK Government's decision to block funding. Funding was allocated to the...

March 20, 2024To play this content, please enable JavaScript, or try another browservideo caption, “I thought it would be the...

A small rock proves that a meteorite struck Greenland about a billion years ago. The crater ruins are among the...

Written by Stefan SchimmeltRajkot's leading cricket writerFebruary 14, 2024To play this content, please enable JavaScript, or try another browservideo caption,...

For buying and selling to work, you must have Javascript enabled and if you have AdBlocker installed, you will need...

It might have been expected that this somewhat provocative premise coupled with the star power behind the project would attract...

picture: Title: World Map with Faces by GPOC Image: N/A The authors' vision is to work towards the global implementation...

Written by Stefan SchimmeltDharamsala's chief cricket writerMarch 9, 2024Image source, Getty ImagesComment on the photo, England have lost four consecutive...

For buying and selling to work, you must have Javascript enabled and if you have AdBlocker installed, you will need...