Written by Will Durrant and Danny FullbrookLocal Democracy Reporting Service and BBC News, HertfordshireMarch 3, 2024Image source, Universal PicturesComment on...

My wife has a BMI over 30 and I'm concerned about her health, but she thinks I'm criticizing her appearance....

Image source, Getty ImagesComment on the photo, Amy Cockayne scored a try before being sent off in England's third round...

For buying and selling to work, you must have Javascript enabled and if you have AdBlocker installed, you will need...

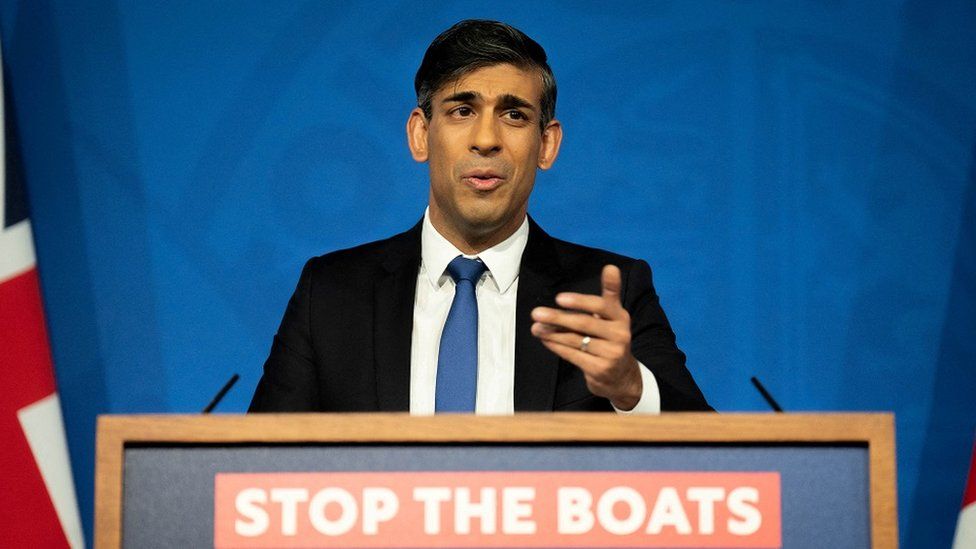

UK Prime Minister Rishi Sunak is in despair. He is losing voters on both the right and the left and...

Belfast rapper Kneecap is threatening legal action over the UK Government's decision to block funding. Funding was allocated to the...

March 20, 2024To play this content, please enable JavaScript, or try another browservideo caption, “I thought it would be the...

A small rock proves that a meteorite struck Greenland about a billion years ago. The crater ruins are among the...

Written by Stefan SchimmeltRajkot's leading cricket writerFebruary 14, 2024To play this content, please enable JavaScript, or try another browservideo caption,...

For buying and selling to work, you must have Javascript enabled and if you have AdBlocker installed, you will need...