Expected results, ongoing investments in digital solutions and Ingka partners“

The first half of 2021 was a successful phase in the strategic renewal journey. We are on our way to becoming a fully sustainable digital bank. During the spring, our first product was successfully launched on the new platform. In June, we brought Ingka as partner. The close partnership with Ingka makes it possible to further accelerate the bank’s transformation. Together, we now have more power to accelerate into the future.”

Henrik Eklund, CEO, Ikano Bank AB (General)

Results for the first half of 2021

(Comparative figures in parentheses refer to June 30, 2020 unless otherwise noted)

- The turnover amounted to SEK 60,623 million (61,584) SEK.

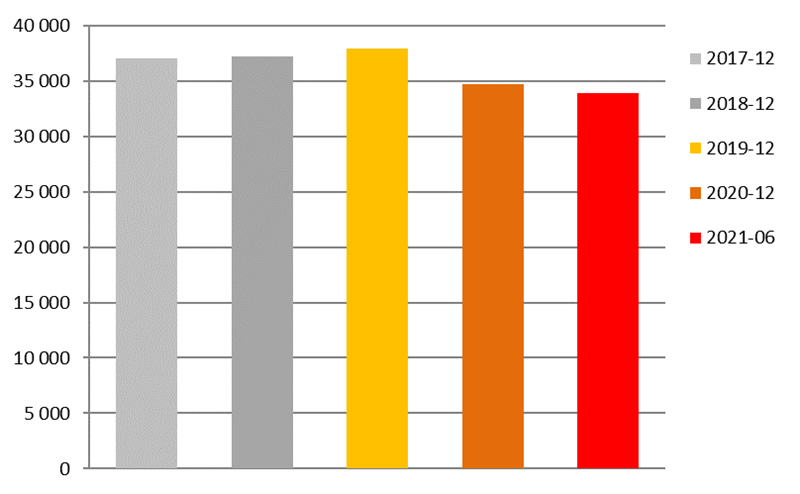

- Lending, including leasing, amounted to SEK 33,952 million (SEK 35,534).

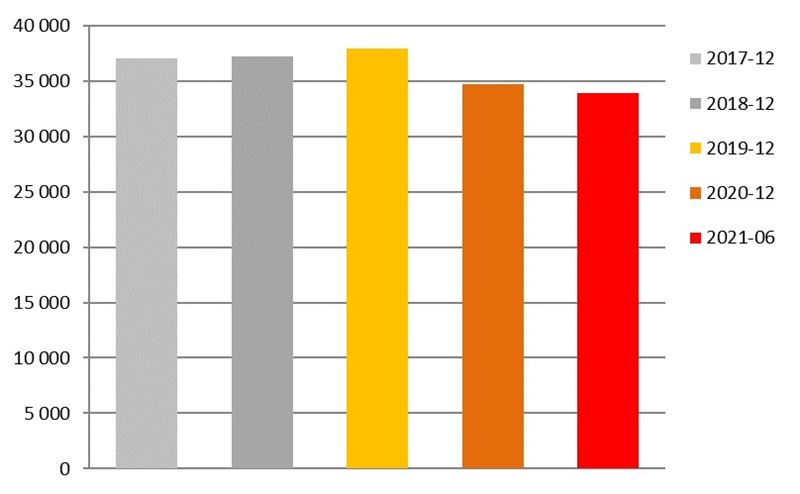

- Deposits from the public amounted to SEK 26,671 million (SEK 26,050).

- Operating profit before credit losses is SEK 270 million (387)

- Net interest income was 855 million SEK (936)

- The equity tier 1 equity ratio decreased to 16.8% (17.1) and the total capital ratio increased to 30.9% (19.6) due to the issuance of new shares.

- Liquidity reserve increased to SEK 3,950 million (2,788) and the total liquidity portfolio was SEK 9,980 million (5,617).

- Loan losses amounted to SEK 209 million (468) SEK.

Prospects for the remainder of 2021

Extensive investments are being made and with Ingka as a partner, we have been able to accelerate the bank’s ongoing transformation, which is aimed at simplifying and improving the bank’s competitiveness. The goal is to eventually become a sustainable digital bank for many people.

For definitions of the alternative key numbers used to describe the Bank’s operations, see the Bank’s 2020 Annual Report, available on the Bank’s website: www.ikanobank.se/om-banken/ekonomisk-information.

Lending including leasing in MSEK Deposits from the public in Swedish krona m

This information must be published by Ikano Bank AB (Public) in accordance with the Swedish Stock Exchange Act. The information was submitted for publication on August 27, 2021 at 11:00 AM.

Ikano Bank’s interim report is available on the bank’s website: www.ikanobank.se/om-banken/ekonomisk-information.

for further information

Henrik Eklund, CEO

Phone: 010-330 40 00

Email: [email protected]

About Ikano Bank AB (Public)

Ikano Bank creates opportunities for a better everyday life by providing simple, elegant and affordable services, for the sake of a healthy economy for many people. Our offer includes savings and loan products for consumers, sales support for retailers and leasing and factoring for businesses. We operate in Sweden, Denmark, Finland, Norway, UK, Poland, Germany and Austria. Ikano Bank is part of the Ikano Group, which owns 51 percent of the bank. The Ingka Group, a strategic partner in the IKEA franchise system that operates more than 378 IKEA stores in 31 countries, owns the remaining 49 percent of the bank. The head office of Ikano Bank is located in Malmö and the company is registered in Älmhult, where the company was previously established.

Tags:

“Extreme tv maven. Beer fanatic. Friendly bacon fan. Communicator. Wannabe travel expert.”

More Stories

Brexit brings economic uncertainty – Finland worst hit in the long run – Hufvudstadsbladet

Britain wants closer ties with the European Union.

Britain may already be out of recession